Today, the Louisiana Department of Revenue published Revenue Information Bulletin No. 20-012 (May 22, 2020), which provides automatic relief from late filing and late payment penalties (La. R.S. 47:1602) and negligence penalty (La. R.S. 47:1604.1) with respect to state sales tax returns for March 2020 and April 2020, which were due on April 20, 2020

Today, the Louisiana Department of Revenue published Revenue Information Bulletin No. 20-012 (May 22, 2020), which provides automatic relief from late filing and late payment penalties (La. R.S. 47:1602) and negligence penalty (La. R.S. 47:1604.1) with respect to state sales tax returns for March 2020 and April 2020, which were due on April 20, 2020

JW SALT Team Presents “Now is the Time! 5 Steps to Restart Your Tax Department” Webinar

As we slowly begin the long process of returning to our offices, it will be very important to have a clearly defined and organized approach to identify upcoming deadlines and document important changes to our core businesses. Please join the Jones Walker SALT team as we discuss these practical issues, including specific steps to take,…

Louisiana Tax Commission Issues Additional Guidance on Property Tax Filing Deadlines

Today, in compliance with Proclamation No. JBE 2020-59, which was issued by Governor Edwards on May 14, 2020, the Louisiana Tax Commission (LTC) issued Statewide Advisory 05-2020 explaining that JBE 2020-59 continues the suspension of the statutory April 1, 2020 deadline for filing personal property renditions…

Mississippi DOR Sets July 15 Income Tax Filing Deadlines

This morning the Mississippi Department of Revenue issued a notice reversing course and setting Mississippi’s income tax filing deadlines for July 15 to coincide with the federal due dates. This applies to individual, corporate and fiduciary returns, and covers return extensions as well as estimated payments for both Q1 and Q2. We now have an…

This morning the Mississippi Department of Revenue issued a notice reversing course and setting Mississippi’s income tax filing deadlines for July 15 to coincide with the federal due dates. This applies to individual, corporate and fiduciary returns, and covers return extensions as well as estimated payments for both Q1 and Q2. We now have an…

Happy Cinco de Mayo!

We hope everyone is enjoying Cinco de Mayo! Here are crawfish enchiladas prepared by Sue Zemanick, owner of Zasu in New Orleans and a James Beard Award winning chef, and a shot (or two) of some amazing tequila, complements of Jay Adams. We enjoyed the enchiladas with perfect margaritas – of course with…

We hope everyone is enjoying Cinco de Mayo! Here are crawfish enchiladas prepared by Sue Zemanick, owner of Zasu in New Orleans and a James Beard Award winning chef, and a shot (or two) of some amazing tequila, complements of Jay Adams. We enjoyed the enchiladas with perfect margaritas – of course with…

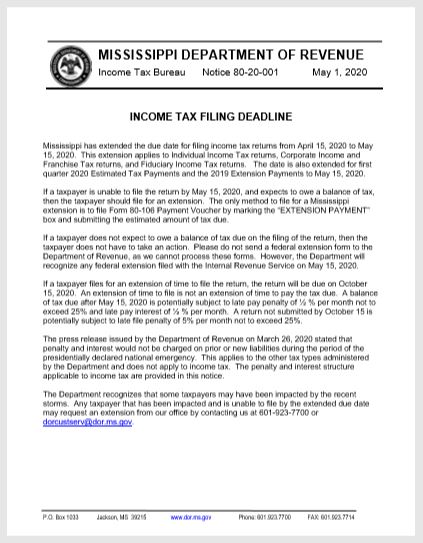

Mississippi DOR Reminds Taxpayers that Income Tax Returns are Due May 15

Mississippi Department of Revenue reminds taxpayers that income tax returns are due May 15 and the state does not follow federal dates.

Mississippi Department of Revenue reminds taxpayers that income tax returns are due May 15 and the state does not follow federal dates.

For additional information, please contact John Fletcher and Bob Box from our team in Mississippi.

Mississippi Legislature will reconvene the 2020 Legislative Session on Monday, May 18

Reposted from Mississippi Lt. Gov. Delbert Hosemann’s Facebook page:

COVID-19 Update: By agreement of Lieutenant Governor Delbert Hosemann and Speaker of the House Philip Gunn, the Mississippi Legislature will reconvene the 2020 legislative session on Monday, May 18.

The Legislature recessed its 125-day session temporarily on March 18, following the governor’s issuance of a

…

Jay Adams Discuss Property Tax Relief for Louisiana Business Property

Property Tax Relief for Louisiana Business Property

by Jay Adams and Joe Landry

Reprinted from Tax Notes State, April 27, 2020, p. 537

Volume 96, Number 4 April 27, 2020

Through multiple proclamations, Louisiana Gov. John Bel Edwards (D) ordered that nonessential businesses close their doors or limit their operations, including restaurants, hotels, casinos, retail

…

Reminder: Not All Louisiana Sales Tax Return Deadlines Have Been Extended

In response to increasing pressures on businesses caused by the COVID-19 pandemic, the Louisiana Department of Revenue has issued several Revenue Rulings and Revenue Information Bulletins to extend specific filing and payment deadlines for certain state taxes. On March 19, 2020, the Louisiana Department of Revenue issued Revenue Information Bulletin No. 20-008 to provide guidance…

Things are still Cookin’ with SALT in New Orleans!

Nothing makes a Friday a bit brighter than an random act of kindness. My neighbor dropped these beautiful and delicious, and hot, glazed doughnuts from La Petite Sophie to Carla and me this morning. So glad I hadn’t had breakfast yet!

Have a great weekend!