The Louisiana Legislature has now sent to conference committee proposed legislation (SB 157) that would exempt the wages of certain nonresident employees from Louisiana individual income taxation, and their employers from withholding and reporting requirements, if the employees only worked in Louisiana for fewer than 25 days in a calendar year.

The Louisiana Legislature has now sent to conference committee proposed legislation (SB 157) that would exempt the wages of certain nonresident employees from Louisiana individual income taxation, and their employers from withholding and reporting requirements, if the employees only worked in Louisiana for fewer than 25 days in a calendar year.

If SB

As word spread about the Supreme Court’s opinion in

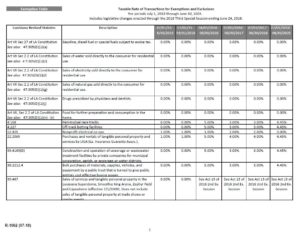

As word spread about the Supreme Court’s opinion in  The Louisiana Department of Revenue has now issued a revised

The Louisiana Department of Revenue has now issued a revised  A call to action from our friends at COST:

A call to action from our friends at COST: It’s now official. Louisiana Governor Jon Bel Edwards (D) has finally released his

It’s now official. Louisiana Governor Jon Bel Edwards (D) has finally released his  Louisiana Governor John Bel Edwards (D) recently met with leaders from the Louisiana Legislature to discuss his draft

Louisiana Governor John Bel Edwards (D) recently met with leaders from the Louisiana Legislature to discuss his draft