On September 24, the Mississippi Department of Revenue filed a proposed amendment to its sales tax regulation on Computer Equipment, Software and Services. This amendment appears to reverse longstanding sales and use tax policy with respect to remote internet-based computer services, and could result in a significant non-legislative tax increase on Mississippi businesses. The notice

Tax News

Louisiana Secretary of State Announces Rescheduling of Upcoming Tax Reform Vote to November 13

Louisiana Secretary of State Kyle Ardoin has now announced the rescheduling of the upcoming tax reform constitutional amendment votes and other Fall elections, which were to be held October 9. The Fall elections and related tax reform votes are now scheduled to be held November 13.

This change was recommended by the Secretary of…

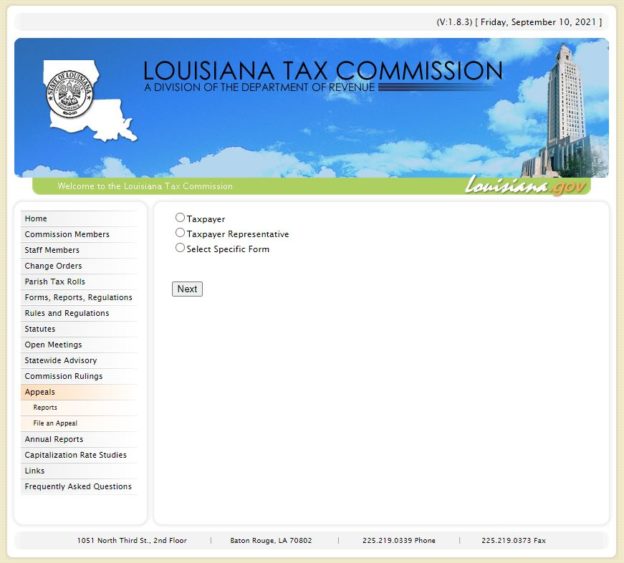

Louisiana Tax Commission Online Appeals Portal is OPEN for the Tax Year 2021

The Louisiana Tax Commission Online Appeals Portal is OPEN for the Tax Year 2021 (2022 Orleans Parish) on the LTC website.

The Louisiana Tax Commission Online Appeals Portal is OPEN for the Tax Year 2021 (2022 Orleans Parish) on the LTC website.

To file an appeal:

- Go to http://www.latax.state.la.us/Default.aspx

- Click Appeals

- Click File an Appeal

- Follow prompts and upload supporting documents. If supporting documents are a large file, please email them directly to: Malveaux@la.gov

If you…

Property Damage Suffered as a Result of Hurricane Ida Must be Considered by Assessors into Determining the Fair Market Value

In response to the pandemic, the Jones Walker SALT team published an article regarding La. R.S. 47:1978.1 and its mandate that property damaged, destroyed, or rendered nonoperational due to an emergency declared by the governor was subject to reassessment, including the consideration of additional obsolescence, as a result of that physical and financial damage.

In response to the pandemic, the Jones Walker SALT team published an article regarding La. R.S. 47:1978.1 and its mandate that property damaged, destroyed, or rendered nonoperational due to an emergency declared by the governor was subject to reassessment, including the consideration of additional obsolescence, as a result of that physical and financial damage.

In…

Louisiana Department of Revenue Grants Additional Automatic Extensions For Certain Eligible Businesses and Individuals Impacted by Hurricane Ida

The Louisiana Department of Revenue has now issued Revenue Information Bulletin (RIB) 21-024 automatically granting additional extensions to taxpayers in certain Louisiana areas impacted by Hurricane Ida for certain taxes that were due on or after August 26, 2021.

The Department’s new RIB specifically explains which taxpayers are eligible for automatic extensions, by tax type.…

Louisiana Department of Revenue Issues Guidance on Income Tax Relief (and Notice Requirements) for Hurricane Ida Relief Work by Nonresident Businesses or Employees

The Louisiana Department of Revenue has now issued Revenue Information Bulletin (RIB) 21-020, which provides certain income tax relief (and notice requirements) relating to Hurricane Ida relief work performed in the State by nonresident businesses or employees.

Louisiana law (Act 358, 2017 Reg. Sess.) provides for an income tax exclusion from…

Following Hurricane Ida, Louisiana Department of Revenue Grants Automatic Filing and Payment Extensions for Tax Returns and Payments with Original or Extended Due Dates on August 31, 2021

The Louisiana Department of Revenue has now issued Revenue Information Bulletin (RIB) 21-021 automatically granting filing and payment extensions to taxpayers for certain Louisiana tax returns and payments due during Hurricane Ida landfall and impact. The Department’s new RIB specifically explains that for taxpayers whose homes, principal places of business,…

One Bourbon, One Scotch and One Appraisal. . . It’s Time to Inspect the Property Tax Rolls!

Not that Louisiana property tax issues will make one want to imbibe, but it is that time of the year when the assessment rolls are open for review in Louisiana. The open book dates are currently published on the website of the Louisiana Tax Commission. Most of the rolls will be open the last…

Louisiana Governor Has Now Signed Law Removing 20-Year Carryover Limitation on Net Operating Loss (NOL) Deduction for Corporate Income Tax Purposes

Louisiana’s Governor, John Bel Edwards, has now signed into law SB 36 (enacted as Act 459), which eliminates the prior 20-year carryover period limitation imposed on the available deduction for net operating losses (NOLs) for Louisiana corporate income tax purposes.

Act 459 amends La. R.S. 47:287.86(B) to provide that all NOL deductions claimed on…

I Feel a Change Comin’ On: Louisiana’s 2021 Regular Session Legislative Wrap-Up

The Louisiana Legislature’s 2021 Regular Session has now concluded, and after a long and particularly contentious session, the Legislature was able to get substantial portions of its tax reform package across the finish line.

Prior to the start of the 2021 Regular Session, Louisiana’s legislative leadership identified four main tax reform measures to be addressed,…