Like that much anticipated annual visit to the doctor before school starts, it is again time for Louisiana assessors to open their rolls for taxpayer review, and hopefully no one will need any shots afterwards (but if so, make it tequila!). Many assessors begin the two-week exposure period on August 15th, but the dates vary

Tax News

John Fletcher Quoted in Law360 and TaxNotes on Mississippi Proposed Tax on Cloud Computing Services

Jones Walker SALT partner, John Fletcher, was quoted in the Law360 article “Miss. Pulls Proposed Rule To Tax Cloud Computing Services – Law360” as well as the Tax Notes article “Mississippi Revokes Proposed Sales Tax Reg for Online Computing Services.” Referring to the Mississippi Department of Revenue’s recently withdrawn rule change…

Louisiana Tax Commission Sets Dates for 2023 Rules and Regulations Sessions

For anyone interested in Louisiana property tax issues, the Louisiana Tax Commission has given notice of the dates for its annual Rules and Regulations hearings. Any interested party can submit a proposal to amend the current regulations to the Commission during this process. The Commission accepts written proposals that are presented in an open Commission…

Mississippi Enacts Pass-Through Entity Income Tax Election/ SALT Cap Workaround

Mississippi recently passed a SALT cap workaround in the form of a flow-through entity election. Consistent with the roughly 26 other states having adopted similar schemes, the Mississippi bill presents several grey areas and questions that will need to be addressed through Department of Revenue guidance or possible technical corrections.

H.B. 1691, signed into…

Louisiana Tax Commission Issues Statewide Advisory Regarding Severe Weather Event on March 22

As we have written before, any property owner whose property has been damaged or rendered non-operational as a result of an emergency declared by the governor can seek a reduction in the value of their affected property even though January 1st has passed. See La. R. S. 47:1978.1. On March 23, 2022, Louisiana…

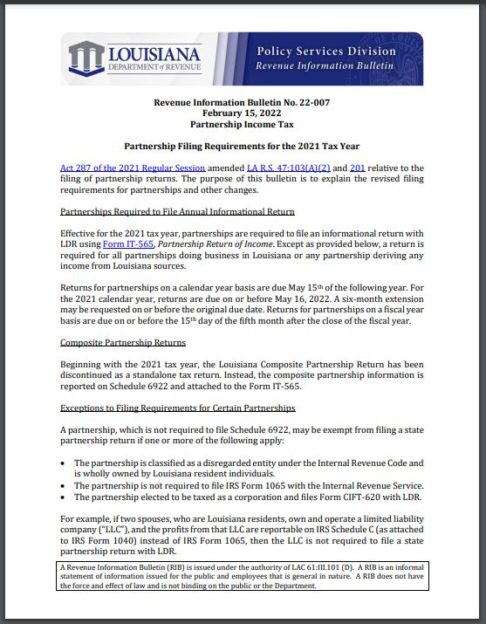

Louisiana Department of Revenue Updates Partnership Reporting Requirements

In the 2021 Louisiana Regular Legislative Session, the Louisiana Legislature enacted Act 287 making wholesale changes to the Louisiana income tax reporting and audit regime for partners and partnerships. Effective June 2021, the Act’s updated reporting obligations were made applicable to 2021 returns filed in 2022, prompting a need for guidance with respect to how…

In the 2021 Louisiana Regular Legislative Session, the Louisiana Legislature enacted Act 287 making wholesale changes to the Louisiana income tax reporting and audit regime for partners and partnerships. Effective June 2021, the Act’s updated reporting obligations were made applicable to 2021 returns filed in 2022, prompting a need for guidance with respect to how…

Cracking the Crypto Code: New Reporting Obligations (Current Developments in the World of Blockchain and Cryptocurrency)

As the usage of Bitcoin, Ether, and other cryptocurrencies proliferates throughout the US economy, it may seem inevitable that a comprehensive regulatory regime will sprout up around these novel assets. Thus far, the regulation has been piecemeal, primarily limited to pronouncements from the Internal Revenue Service (IRS), the Securities and Exchange Commission, and the Office…

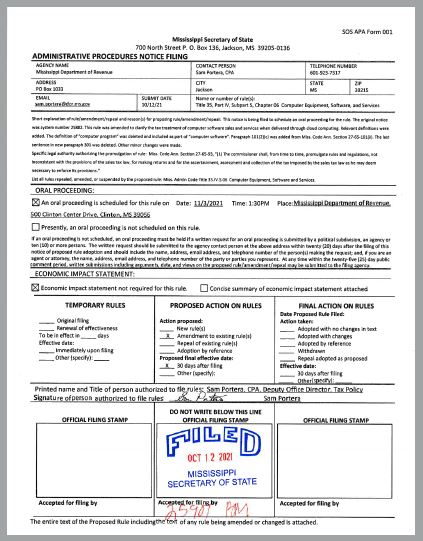

Questions Submitted for Hearing on Mississippi Software Sales Tax Regulation

In anticipation of the upcoming public hearing on Mississippi’s proposed amendments to its sales tax regulation on Computer Equipment, Software and Services, Jones Walker recently submitted a letter to the Mississippi Department of Revenue summarizing a wide range of questions and issues raised by the proposal. These questions were compiled as a result of discussions…

In anticipation of the upcoming public hearing on Mississippi’s proposed amendments to its sales tax regulation on Computer Equipment, Software and Services, Jones Walker recently submitted a letter to the Mississippi Department of Revenue summarizing a wide range of questions and issues raised by the proposal. These questions were compiled as a result of discussions…

Louisiana Announces a New “Transfer Pricing Managed Audit Program”

The Louisiana Department of Revenue (the “Department”) released Revenue Information Bulletin No. 21-029 announcing the “Louisiana Transfer Pricing Managed Audit Program.” Beginning November 1, 2021, eligible corporations may request to participate in the program in order to resolve intercompany transfer pricing issues with the Department. Newly registered taxpayers, existing taxpayers, and taxpayers currently under audit…

UPDATE: Mississippi Attempts to Significantly Increase Sales and Use Taxes on Internet-Based Business Services Via Regulatory Amendment

UPDATE: In response to widespread interest in these changes, the Mississippi Department of Revenue this afternoon scheduled a public hearing on the proposed amendments. The hearing is set for Wednesday, November 3 at 1:30. Interested parties are encouraged to identify specific questions and issues to present to the Department at the hearing. Jones Walker…

UPDATE: In response to widespread interest in these changes, the Mississippi Department of Revenue this afternoon scheduled a public hearing on the proposed amendments. The hearing is set for Wednesday, November 3 at 1:30. Interested parties are encouraged to identify specific questions and issues to present to the Department at the hearing. Jones Walker…