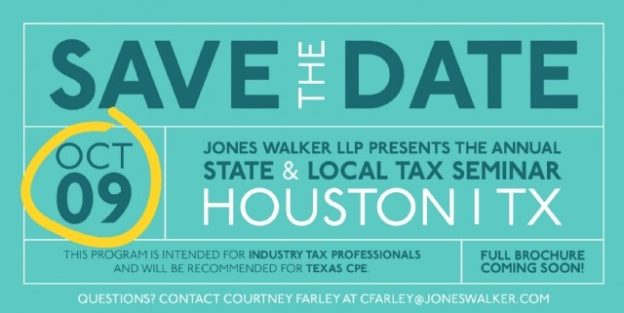

WHEN: WEDNESDAY, OCTOBER 09, 2019

WHERE: HILTON AMERICAS-HOUSTON

Please Save the Date for Jones Walker’s 11th Annual State & Local Tax Seminar!

Be sure to check back for upcoming program details! This program is intended for industry tax professionals and will be recommended for Texas CPE. Full brochure coming soon!

Questions? Contact Courtney Farley at

Jones Walker SALT Team

Jones Walker SALT Team