In response to increasing pressures on businesses caused by the COVID-19 pandemic, the Louisiana Department of Revenue has issued several Revenue Rulings and Revenue Information Bulletins to extend specific filing and payment deadlines for certain state taxes. On March 19, 2020, the Louisiana Department of Revenue issued Revenue Information Bulletin No. 20-008 to provide guidance

Louisiana Department of Revenue

Louisiana Department of Revenue Extends April 25, 2020 Severance Tax Filing and Payment Deadline to June 25, 2020: Automatic Extension with No Penalties or Interest

Today, the Louisiana Department of Revenue issued Revenue Information Bulletin (RIB) No. 20-011, which provides filing and payment extension relief for monthly Louisiana severance tax returns, payments, and reports due on April 25, 2020.

The RIB provides that the filing and payment deadline for the February 2020 monthly oil and gas severance tax return,…

Jay Adams presents at IPT Sales Tax I School

Jay Adams was an instructor at the IPT Sales Tax I School in Atlanta, Georgia where he presented to over 200 attendees on recognizing the hierarchy of laws, understanding the consequences of specific decisions when working with the Department of Revenue and ways to resolve disputes, and identifying the four prongs of the commerce clause…

Jay Adams was an instructor at the IPT Sales Tax I School in Atlanta, Georgia where he presented to over 200 attendees on recognizing the hierarchy of laws, understanding the consequences of specific decisions when working with the Department of Revenue and ways to resolve disputes, and identifying the four prongs of the commerce clause…

Louisiana Remote Seller Commission Issues Second Information Bulletin – RSIB 18-002 – Addressing Definition of “Remote Seller” and Further Guidance to Remote Sellers

The Louisiana Sales and Use Tax Commission for Remote Sellers (the “Commission”) has now officially issued its second information bulletin – Remote Sellers Information Bulletin (“RSIB”) 18-002 – which provides a general definition for “remote sellers,” as well as further administrative guidance regarding current and future registration, collection, remittance, and reporting requirements for “remote sellers.” …

Not So Fast: Louisiana State and Local Sales Taxes in a Post-Wayfair World

As word spread about the Supreme Court’s opinion in South Dakota v. Wayfair, Inc., Dkt. No. 17-494, 485 U.S. (June 21, 2018), tax administrators around the country popped open bottles of champagne and began toasting the end of the “physical presence” substantial nexus standard. The sounds of celebration were, at least initially, particularly deafening in Louisiana, with its sixty-three (63) autonomous parish taxing jurisdictions that levy, administer and collect local sales and use tax on behalf of numerous cities, towns, districts and other local jurisdictions. Remote sellers might have considered downing a drink or two to drown their sorrows at the thought of potentially having to navigate the complex systems of state and local sales taxes in Louisiana.

As word spread about the Supreme Court’s opinion in South Dakota v. Wayfair, Inc., Dkt. No. 17-494, 485 U.S. (June 21, 2018), tax administrators around the country popped open bottles of champagne and began toasting the end of the “physical presence” substantial nexus standard. The sounds of celebration were, at least initially, particularly deafening in Louisiana, with its sixty-three (63) autonomous parish taxing jurisdictions that levy, administer and collect local sales and use tax on behalf of numerous cities, towns, districts and other local jurisdictions. Remote sellers might have considered downing a drink or two to drown their sorrows at the thought of potentially having to navigate the complex systems of state and local sales taxes in Louisiana.

As tax administrators continued to read the Wayfair opinion, however, a sobering reality began to set in that, at least in the short term, Louisiana’s various taxing jurisdictions are in no better position to force remote sellers to collect and remit state and local sales taxes than they were before the Wayfair decision (and perhaps even a worse one).

Continue Reading Not So Fast: Louisiana State and Local Sales Taxes in a Post-Wayfair World

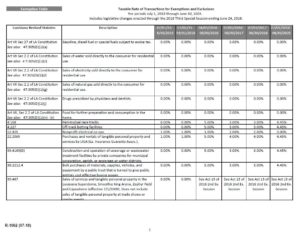

Louisiana Department of Revenue Issues New “Taxable Rate” Chart to Explain State Sales Tax Changes Following Enactment of Recent Tax Revenue Bill

The Louisiana Department of Revenue has now issued a revised “Taxable Rate” chart (Form R-1002) to provide the Department’s understanding of the new Louisiana state-level sales/use/lease tax rates following the Louisiana legislature’s enactment of the sales tax revenue measure Act 1 (HB 10) in the recently-concluded third special session of the legislature, effective July 1,…

The Louisiana Department of Revenue has now issued a revised “Taxable Rate” chart (Form R-1002) to provide the Department’s understanding of the new Louisiana state-level sales/use/lease tax rates following the Louisiana legislature’s enactment of the sales tax revenue measure Act 1 (HB 10) in the recently-concluded third special session of the legislature, effective July 1,…

GAME ON: Louisiana Department of Revenue and Other State Agencies Look to Even the Score on Employee Misclassification

The Louisiana Department of Revenue (DOR) has joined forces with other Louisiana agencies to crackdown on employee misclassification and failure to withhold payroll taxes. The GAME ON (Government Against Misclassified Employees Operational Network) Task Force is an interagency network made up of members of the Louisiana Workforce Commission’s (LWC…

Tax Clearance Now Required for Louisiana State Sales Tax Resale Certificates and Approval of Certain State Procurement Contracts

The Louisiana Department of Revenue has now issued formal guidance regarding the new requirement that taxpayers receive a Louisiana state tax clearance in order to obtain: (i) a new or renew an existing Louisiana state sales tax resale certificates; and (ii) approval of certain Louisiana state procurement contracts.

The Louisiana Department of Revenue has now issued formal guidance regarding the new requirement that taxpayers receive a Louisiana state tax clearance in order to obtain: (i) a new or renew an existing Louisiana state sales tax resale certificates; and (ii) approval of certain Louisiana state procurement contracts.

Specifically, the Department has issued the following…

Louisiana and Other States Provide Tax Relief for Hurricane Victims

In response to the impact of Hurricanes Harvey and Irma, parts of the United States have been declared as major disaster areas by the federal government. As a result, numerous states have enacted delayed filing and payment periods for individuals and businesses located in these major disaster areas. Louisiana has joined this growing list with…

In response to the impact of Hurricanes Harvey and Irma, parts of the United States have been declared as major disaster areas by the federal government. As a result, numerous states have enacted delayed filing and payment periods for individuals and businesses located in these major disaster areas. Louisiana has joined this growing list with…

Much Ado About Nothing: Louisiana’s 2017 Regular Session Legislative Wrap-Up

The Louisiana Legislature’s 2017 Regular Session has now concluded, and as previously reported, numerous tax measures were proposed. Ultimately, however, much of the proposed legislation addressing long-term tax reform was largely rejected by the Legislature during the Regular Session, leaving questions currently unanswered as to how the state will ultimately address the long-term issue…

The Louisiana Legislature’s 2017 Regular Session has now concluded, and as previously reported, numerous tax measures were proposed. Ultimately, however, much of the proposed legislation addressing long-term tax reform was largely rejected by the Legislature during the Regular Session, leaving questions currently unanswered as to how the state will ultimately address the long-term issue…