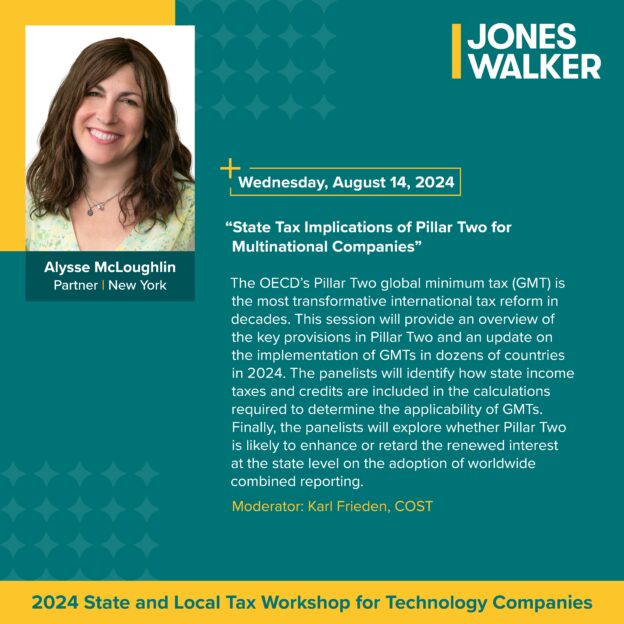

Join Alysse McLoughlin and Chris Lutz, partners on the state and local tax team, at the NYU 44th Institute on State and Local Taxation, in New York, New York, on December 8-9, 2025.

Alysse serves as the program co-chair for the event. Chris will present on “The Intersection of Important International Issues” panel