Congratulations to our former Jones Walker partner Kimberly Lewis on her new leadership role at Louisiana State University. The university is in excellent hands with Kim!

Key Ingredients Impacting State & Local Tax Issues

Congratulations to our former Jones Walker partner Kimberly Lewis on her new leadership role at Louisiana State University. The university is in excellent hands with Kim!

Today the Mississippi House of Representatives filed and passed out of the Ways and Means Committee H.B. 531 which appears to represent the House leadership’s income tax elimination proposal for the 2022 session. The bill, which is 294 pages long, appears to have the following primary features:

Today the Mississippi House of Representatives filed and passed out of the Ways and Means Committee H.B. 531 which appears to represent the House leadership’s income tax elimination proposal for the 2022 session. The bill, which is 294 pages long, appears to have the following primary features:

…

Jones Walker SALT partner Alysse McLoughlin and associate Jeff Birdsong in the Tax Practice Group presented at the The Life Insurance Council of New York 2021 Virtual Tax Conference on December 16.

Alysse and Jeff spoke on the “State and Local Tax Update Panel” covering remote worker issues and other state tax developments.

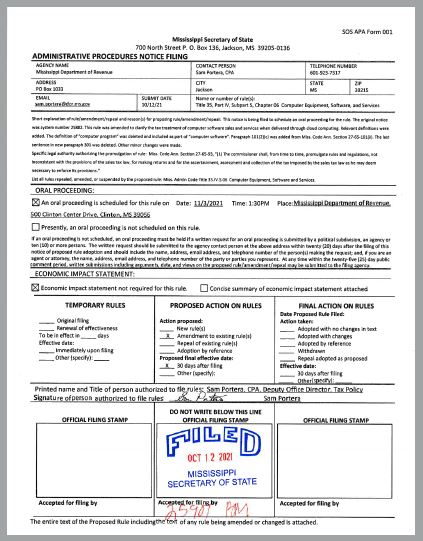

In anticipation of the upcoming public hearing on Mississippi’s proposed amendments to its sales tax regulation on Computer Equipment, Software and Services, Jones Walker recently submitted a letter to the Mississippi Department of Revenue summarizing a wide range of questions and issues raised by the proposal. These questions were compiled as a result of discussions…

In anticipation of the upcoming public hearing on Mississippi’s proposed amendments to its sales tax regulation on Computer Equipment, Software and Services, Jones Walker recently submitted a letter to the Mississippi Department of Revenue summarizing a wide range of questions and issues raised by the proposal. These questions were compiled as a result of discussions…

The Louisiana Department of Revenue (the “Department”) released Revenue Information Bulletin No. 21-029 announcing the “Louisiana Transfer Pricing Managed Audit Program.” Beginning November 1, 2021, eligible corporations may request to participate in the program in order to resolve intercompany transfer pricing issues with the Department. Newly registered taxpayers, existing taxpayers, and taxpayers currently under audit…

UPDATE: In response to widespread interest in these changes, the Mississippi Department of Revenue this afternoon scheduled a public hearing on the proposed amendments. The hearing is set for Wednesday, November 3 at 1:30. Interested parties are encouraged to identify specific questions and issues to present to the Department at the hearing. Jones Walker…

UPDATE: In response to widespread interest in these changes, the Mississippi Department of Revenue this afternoon scheduled a public hearing on the proposed amendments. The hearing is set for Wednesday, November 3 at 1:30. Interested parties are encouraged to identify specific questions and issues to present to the Department at the hearing. Jones Walker…

Jones Walker SALT Team members Jay Adams, Bill Backstrom, and Alysse McLoughlin will present at the 28th Annual Paul J. Hartman State & Local Tax Forum October 27-29, 2021 in Nashville, TN.

The Professor Paul J. Hartman Memorial State and Local Tax (SALT) Forum, sponsored in conjunction with the Vanderbilt University Law…

On September 24, the Mississippi Department of Revenue filed a proposed amendment to its sales tax regulation on Computer Equipment, Software and Services. This amendment appears to reverse longstanding sales and use tax policy with respect to remote internet-based computer services, and could result in a significant non-legislative tax increase on Mississippi businesses. The notice…

Wednesday, October 6, 2021 | Zoom Webinar

Out of an abundance of caution and to better suit our attendees’ needs, we have decided to transition our October 6 SALT Seminar to a virtual format. We hope that you will be able to join us for our updated virtual program!

The Jones Walker LLP State and…