In a Monday press conference on Facebook Live, Mississippi Governor Tate Reeves laid out an ambitious plan to eliminate the state’s individual income tax in the upcoming legislative session starting in January. The tax, levied at a maximum rate of 5%, was trimmed in 2016 when the Legislature eliminated the 3% tax bracket levied on

Tax News

Adams and Backstrom Author Oilman Magazine Article on the Impact of Refinery Closures

Jay Adams and Bill Backstrom authored the Oilman Magazine article “Squeezing the (Remaining) Golden Geese: Refinery Closures May Lead to Increased Tax Scrutiny on Operating Facilities” on the effects that closed refinery facilities may have on owners, local community, and state and local governmental authorities as well as strategies businesses can use to maintain property…

REMINDER: Alabama Department of Revenue Now Requires Annual Renewal of Alabama Tax Licenses, Beginning November 1, 2020

This is a reminder to all businesses registered in Alabama for sales, rental, sellers use, lodgings, utility gross receipts, or simplified sellers use tax purposes and who are required under current law to obtain a corresponding license from the Alabama Department of Revenue (ADOR) that you are now required to renew these licenses annually beginning…

JW SALT Team Presents Webinar: Legislative Update 2020 – Get the Scoop on Louisiana’s Efforts at Tax Reform

With a heavily business-friendly state legislature, before the pandemic, significant pro-business tax reform was on the legislative agenda. Please join members of the Jones Walker SALT team and special guest Senator R.L. “Bret” Allain, II, Louisiana State Senate, as we discuss what did pass, what did not, and what the future may hold for further…

Reminder! JW SALT Team Presents “Now is the Time! 5 Steps to Restart Your Tax Department” Webinar

There is still time to register!

As we slowly begin the long process of returning to our offices, it will be very important to have a clearly defined and organized approach to identify upcoming deadlines and document important changes to our core businesses. Please join the Jones Walker SALT team as we discuss these practical…

Louisiana Tax Commission Issues Additional Guidance on Property Tax Filing Deadlines

Today, in compliance with Proclamation No. JBE 2020-59, which was issued by Governor Edwards on May 14, 2020, the Louisiana Tax Commission (LTC) issued Statewide Advisory 05-2020 explaining that JBE 2020-59 continues the suspension of the statutory April 1, 2020 deadline for filing personal property renditions…

Mississippi DOR Sets July 15 Income Tax Filing Deadlines

This morning the Mississippi Department of Revenue issued a notice reversing course and setting Mississippi’s income tax filing deadlines for July 15 to coincide with the federal due dates. This applies to individual, corporate and fiduciary returns, and covers return extensions as well as estimated payments for both Q1 and Q2. We now have an…

This morning the Mississippi Department of Revenue issued a notice reversing course and setting Mississippi’s income tax filing deadlines for July 15 to coincide with the federal due dates. This applies to individual, corporate and fiduciary returns, and covers return extensions as well as estimated payments for both Q1 and Q2. We now have an…

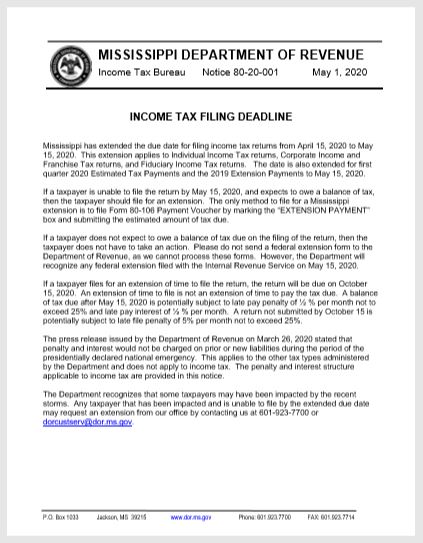

Mississippi DOR Reminds Taxpayers that Income Tax Returns are Due May 15

Mississippi Department of Revenue reminds taxpayers that income tax returns are due May 15 and the state does not follow federal dates.

Mississippi Department of Revenue reminds taxpayers that income tax returns are due May 15 and the state does not follow federal dates.

For additional information, please contact John Fletcher and Bob Box from our team in Mississippi.

Mississippi Legislature will reconvene the 2020 Legislative Session on Monday, May 18

Reposted from Mississippi Lt. Gov. Delbert Hosemann’s Facebook page:

COVID-19 Update: By agreement of Lieutenant Governor Delbert Hosemann and Speaker of the House Philip Gunn, the Mississippi Legislature will reconvene the 2020 legislative session on Monday, May 18.

The Legislature recessed its 125-day session temporarily on March 18, following the governor’s issuance of a

…

Jay Adams Discuss Property Tax Relief for Louisiana Business Property

Property Tax Relief for Louisiana Business Property

by Jay Adams and Joe Landry

Reprinted from Tax Notes State, April 27, 2020, p. 537

Volume 96, Number 4 April 27, 2020

Through multiple proclamations, Louisiana Gov. John Bel Edwards (D) ordered that nonessential businesses close their doors or limit their operations, including restaurants, hotels, casinos, retail

…